How Many Data Centers in India? Complete Overview

The digital boom in India, streaming, e-commerce, AI, and cloud adoption are driving enormous demand in terms of local infrastructure that is reliable. In the event that you have asked yourself, “How Many Data Centers in India?” to plan capacity, select a colocator, or comprehend the market, this guide is an understandable, current, and EEAT-centric perspective on the current state, the factors driving the rapid growth, and the future outlook.

Facilities Counting (colocation, hyperscale, enterprise, and edge), various estimates equalize to approximately 130-150 operational data centers as of 2025 in India, and dozens more are announced or under development. That figure is in line with other industry overviews and reports on colocation.

Market Size and Growth of India Data Center

The India data center market is the fastest expanding in the world. The demands are still growing as the migration to the cloud, artificial intelligence use, and more stringent data localization provisions are being implemented.

- Market size (2025): USD 10–14 billion.

- Early 2030s forecast: USD 25-45 billion.

- Projected CAGR: 13 percent growth in 10 years.

Capacity Development of the Infrastructure

- Installed capacity (early 2025): More than 1 GW.

- Projected by 2026: Over 2 GW

- Expected by 2030: 8–9 GW

Analysts forecast USD 30-50 billion of investments by 2030 with Mumbai taking up a significant portion of the new capacity. This growth makes India a world digital infrastructure giant.

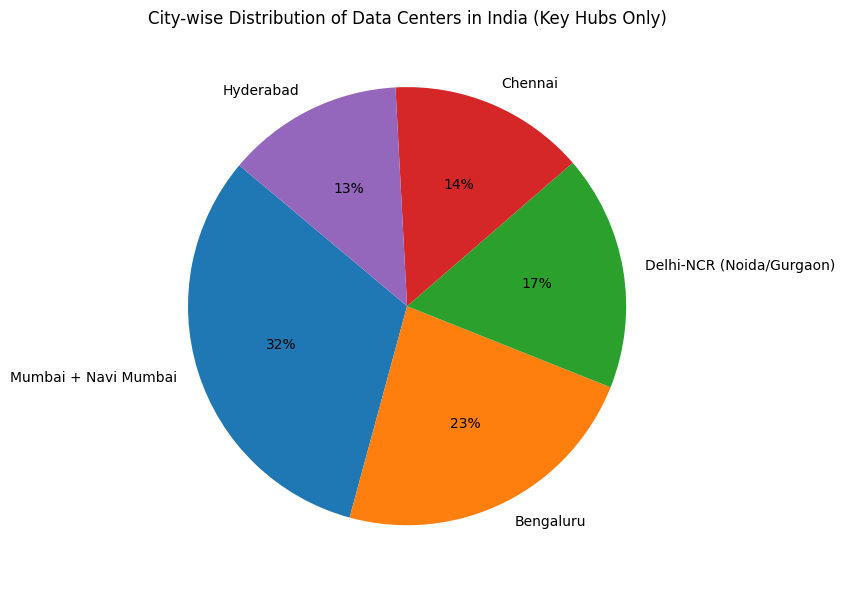

City-wise Overview: Locations of the data center in India

- Mumbai, Maharashtra, India / Navi Mumbai

The landing hub of the west coast gateway and submarine cable. The cities of Mumbai and Navi Mumbai in Maharashtra, India, have a high concentration of colocation and hyperscale investment, which is attributed to the presence of cable connections to the Middle East, Europe, and Southeast Asia. Navi Mumbai is reported to have been the single biggest cluster of capacity in India. This corridor is targeted by major players and new hyperscale campuses.

- Bengaluru, Karnataka, India

The IT capital of India has high demand among cloud, SaaS, and enterprise buyers. The combination of hyperscale, carrier hotels, and colocation in Bengaluru guarantees the existence of a rich ecosystem of talent and vendors.

- Delhi-NCR, Noida, Uttar Pradesh, India

The North India gateway is close to government agencies and big businesses. Expansion in Noida and Gurgaon is due to demand in regulatory compliance and low latency of services within the capital area.

- Chennai, Tamil Nadu, India

The advantage of Chennai is that international submarine cables arrive at the east coast location, and thus, it is a strategic location to interconnect the APAC traffic.

- Hyderabad, Telangana, India

An expanding hub that has good IT/ITES needs, which enjoys the advantage of infrastructure projects and new modes of transportation.

Major characteristics and drivers of market growth

- Data localization and alignment: Indian regulations and corporate requirements would motivate onshore workload data residency and bring investment.

- Cloud & AI workloads: Hyperscalers and cloud customers require local capacity to perform and reduce egress costs.

- Rushing digital demand: billions of internet interactions, streaming, gaming, fintech, and e-commerce generate inertial demand.

- Tax and incentive benefits: recent budget and policy actions will result in data center and electronics manufacturing tax certainty and incentives.

Edge and 5G deployments Edge sites and regional sites are being introduced, which are smaller and can support low-latency apps.

The future of data centers in india (what to expect)

- Speedy scale-up capacity: various analysts estimate that the power in place in data centers in India will surpass the 2 GW threshold by 2026 and increase to several GW by 2030 due to hyperscalers and local operators.

- Campus expansion: In place of single buildings, operators are building campus-style hyperscale buildings that are built in stages.

- Sustainability focus: renewable energy purchase, on-site solar, and energy efficiency will be enforced in new constructions.

- Distributed edge: smaller locations around cities to cater to low-latency and IoT and AR/VR applications.

- Consolidation & partnerships: local companies collaborating with international cloud service providers (or being acquired) to grow at a higher rate.

FAQs

- Where are most data centers located in India?

The location of most of the capacity and commercial colocation is in the Mumbai/Navi Mumbai region, then Bengaluru, Noida/Delhi-NCR, Chennai, Hyderabad, and Pune. This distribution is defined by cable landings, enterprise demand, and hyperscaler investments.

- How many data centers are there in India?

Methods of counting are different, but according to the latest industry surveys, there are about 130 to 150 working commercial data centers (2025), and more announced and under-construction data centers have the industry adding to a much larger total depending on rules of inclusion.

- What are the Tier 1, Tier 2, Tier 3, and Tier 4 data center?

- Tier I: Single path of basic capacity, power/cooling, and availability of about 99.671%.

- Tier II: Tier II has greater uptime than Tier I and is approximately 99.741% available.

- Tier III: (Multiple power/cooling paths) can be serviced whilst available and is approximately 99.982% available.

- Tier IV: Fault-tolerant, has a redundancy of each component and path of distribution, and has the highest uptime at 99.995%.

Tier classification is a unitary manner of showing design and anticipated uptime selected based on the criticality of workloads.

- Will India construct additional hyperscale data centers?

Yes. Hyperscalers and large colocation providers are strategizing expansions and new campuses on a large scale to satisfy the needs of cloud, artificial intelligence, and streaming, backed up by policy incentives and capital flows.