Best 7 GST Billing Software in India for 2026

It is not that only making invoices is part of the financial management in 2026. Indian businesses are burdened with excessive compliance requirements due to the continuously changing GST regulations, e-invoicing requirements, and deadline to submit returns. Unfortunately, many enterprises still rely on a manual billing system such as spreadsheets and custom invoicing registers.

But the truth is this and is as follows:

- Manual invoicing allows mistakes in the form of an incorrect HSN number and a wrong GST percentage and calculation.

- Time-taking: The process of making individual invoices manually reduces the growth of an organization.

- Threats of information hostility: no electronic data management or backup.

- Issues related to compliance: fines can be imposed because of a failure to file a GST return in a timely manner.

- Lack of insights implies lack of analytics to track sales, expenditure, or outstanding debts.

Effective GST software helps in this case. It assists in saving time for businesses with no tax penalties, automation of invoicing, and ensuring GST compliance.

What is GST Billing Software?

A computer-based tool called GST billing software was created to automate the creation of invoices that comply with GST, the filing of returns, and the administration of company accounts. It boosts productivity and ensures that companies comply with the GST laws of India.

The main attributes of GST Billing Software are:

- GST invoices: CGST, SGST and IGST are automatically computed.

- E-invoicing support: connectivity to government sites to make uploads.

- Inventory: involves billing and inventory.

- Multi-User Access: is ideal for growing companies.

- Cloud hosting features are secure, regardless of the location at any given time.

Top 7 GST Billing Software in India by 2026

This is the comprehensive guide to the 7 best GST billing software in India in 2026.

- TallyPrime: ERP Industry Standard.

Tally, which has been the most reputable brand in India since 1986, has been in the accounting and GST billing business. The latest version is TallyPrime, which offers powerful accounting and billing features to SMEs and businesses.

- High levels of GST compliance (with electronic waybills and invoices).

- Careful accounting (balance sheet, trial balance, ledgers, and P&L).

- Inventory tracking per batch of inventories in large numbers of locations.

- Remote access to accountants and business owners.

- Manages massive amounts of data with ease.

Best For: Companies that need a single platform for end-to-end accounting, billing, and GST compliance.

- Busy Accounting Software: Sufficient and Trustworthy.

“Busy” is also a word that the MSMEs in India have had faith in over many years. It is famous for the combination of inventory, accounting, and invoicing. The scalability and flexibility of Busy are suitable for companies that have multiple branches.

- GST-Ready billing, which supports HSN/SAC.

- Inventory of large quantities of inventories in numerous locations (batch and expiry).

- MIS makes high-volume reports for decision-making.

- Personalized invoices.

Best For: MSMEs seeking a scalable yet affordable GST billing solution.

- Marg ERP: Indian Growth Partner

Marg ERP has been delivering its services to Indian companies over the course of 32 years, and uptake is predominantly high in the retail, FMCG, and pharmaceutical sectors. Its ability to do much more than billing includes such features as ERP-to-ERP ordering, e-commerce connection, and GST compliance.

- GSTR filing, e-way bill creation, and GST-compliant invoicing.

- ERP-to-ERP ordering for retailers and distributors.

- Suite of mobile apps for sales, delivery, owners, and retailers.

- Instant payments with Marg Pay and WhatsApp invoicing.

Best For: SMEs in manufacturing, retail, FMCGs, and pharmaceuticals that require a complete ERP with GST billing.

- SAP Business One Enterprise-Grade ERP (SAP HANA).

SAP Business One (SAP HANA) is an international ERP program that is specifically based on medium-sized and large businesses in India. It offers financial management capabilities and intelligent GST billing features for the enterprise.

- GST-compliant automated financial reporting.

- Multiple currency and branch support.

- Sales, human resources, and procurement ERP integration.

- Advanced analytics and real-time dashboards.

Best For: Businesses that require a single, comprehensive analytics solution for both ERP and GST billing.

- Microsoft Dynamics NAV (Navision)

Microsoft Dynamics NAV is used by many multinational corporations now, including a part of Dynamics 365 Business Central. It is the ideal ERP + billing solution for multinationals because it can be customized to meet the requirements of the Indian GST.

- Full financial management, GST billing.

- Integration to Power BI and Microsoft 365.

- High-level BI decision-making dashboards.

- Development of GST invoices and support of the submission of returns.

Best Use: global companies and massive enterprises that demand a worldwide ERP ecosystem with the use of GST.

- Zoho Books Cloud-First GST Billing

Zoho Books is one of the most popular cloud-based GST billing applications in India currently. It is trusted by startups and SMEs due to its low cost, automation, and user-friendliness.

- GST invoicing, which is in favour of electronic invoicing.

- Anywhere cloud access.

- An application that can be tracked on the go to track expenses and invoices.

- Easy integration with third-party applications and Zoho applications.

Best For: Startups and SMEs that have limited budgets and require straightforward cloud-based GST billing software.

- NetForChoice Billing Solutions: Secure Cloud-Hosted

NetForChoice Billing Solutions can be compared with traditional solutions that will only focus on invoicing; they offer enterprise-grade cloud hosting, 24/7 managed support, and GST compliance.

- GST-Compliant Billing prepares GST invoices that are error-free.

- Incorporation of e-invoicing: ready to comply with the law.

- To ensure maximum security, cloud hosting is stored in Tier IV data centres.

- 24/7 Managed Support: 24/7 support when you need it, enterprise-level support.

- Scalability can be applied to large businesses, SMEs, and startups.

- And business continuity is achieved through data backup and recovery.

Best for: Ideal companies who want their GST billing to be safe and as a cloud-based solution and with uptime and compliance guarantees.

Top 6 Benefits of Using Busy on Cloud

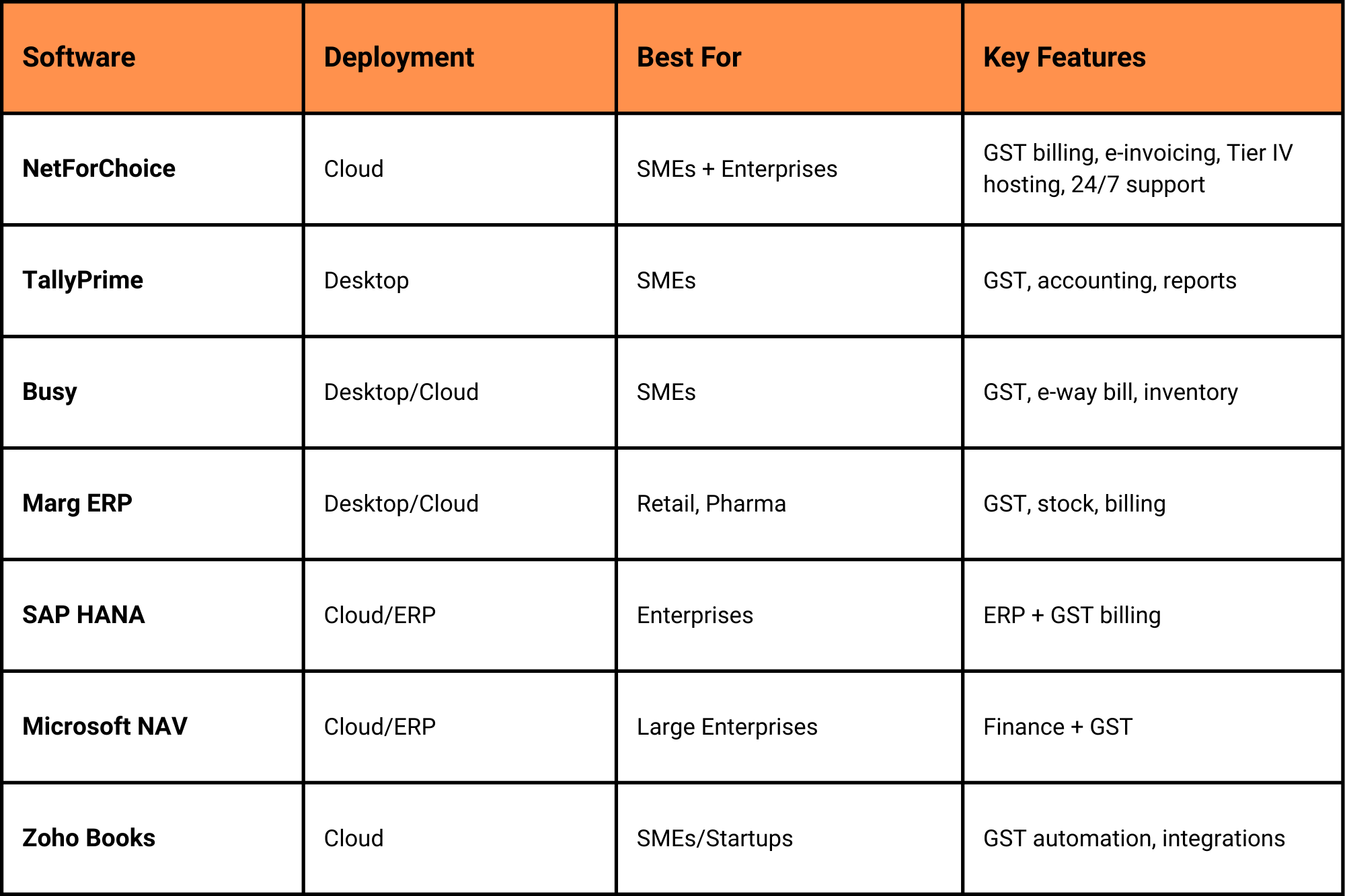

Quick Comparison Table

Why Choose NetForChoice Billing Solutions?

- Enterprise-Grade Infrastructure: NFC provides GST billing housed on Tier IV DCs, in comparison to the desktop solutions.

- Outstanding Security: Protection against ransomware, disaster recovery, and data backup.

- Always-On Support: Controlled assistance 24/7 for comfort.

- Future-Ready: scalable cloud-based GST billing systems for the future.

Conclusion

Choosing the best GST billing software in India depends on your business size, industry, and compliance needs. While desktop solutions like TallyPrime, BUSY, Marg ERP, SAP Business One, and Microsoft Dynamics NAV are popular, modern businesses now prefer ERP on Cloud for better security, scalability, and remote access.

Instead of local systems, companies are moving to:

-

Tally on Cloud for secure remote accounting

-

BUSY on Cloud for MSME billing and inventory

-

Marg on Cloud for retail & pharma businesses

-

SAP HANA on Cloud for enterprise analytics

-

Navision on Cloud for global ERP integration

NetForChoice offers fully managed, secure ERP on Cloud solutions with Tier IV data centers, backups, and 24/7 support, making your GST billing future-ready and compliant.

FAQs

Q1. What is India’s best GST billing software for 2026?

For SMEs → Tally/Busy. For retail → Marg ERP. For cloud → Zoho Books. For secure enterprise-grade cloud billing → NetForChoice.

Q2. How can I select the best billing program?

Verify cloud hosting, automation, scalability, support, and GST compliance.

Q3. Is cloud-based GST billing better than desktop software?

Yes, since it offers improved security, automatic backups, and anytime access.

Q4. What makes NetForChoice superior to other options?

In addition to cloud hosting, Tier IV security, backup, and continuous support, NFC provides GST billing.